A Lancashire council leader has launched a defence of private school arrangements amid government plans to introduce VAT on their fees.

Conservative Coun Stephen Atkinson, the leader of Ribble Valley Council, said Lancashire private schools make a valuable contribution to local economies and are used by ‘normal people’.

The new Labour government says the planned tax revenue from private schools and private sixth forms would boost state education and fund 6,500 new teachers in England. But some private schools, including fee-paying Christian and Muslim schools, have criticise the plans. Some, such as faith schools, are seeking VAT exemptions.

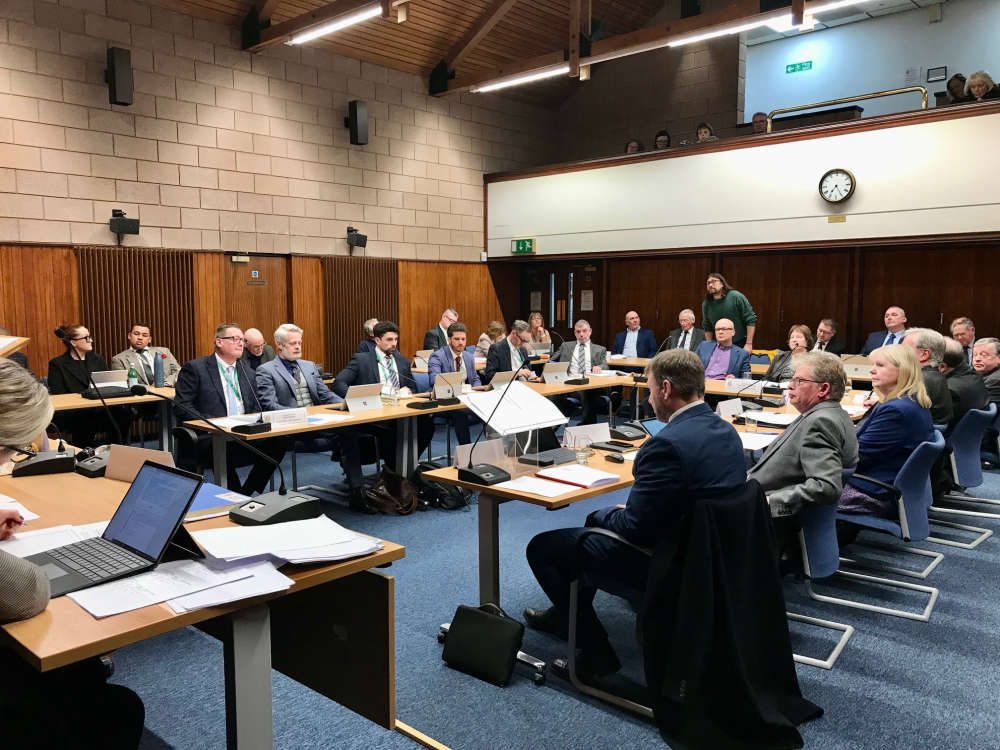

Coun Atkinson raised the topics of private schools, VAT and business rates at the borough council’s latest full meeting. He spoke ahead of the new government’s autumn budget.

He said: “Independent schools contribute nearly £9million to the local economy, employing 218 people and generating £5million in tax revenue. And I think about the sacrifices these parents and grandparents make, often forsaking family holidays, designer clothes and Taylor Swift concerts.

“This is a serious topic. One-in-five of children at independent schools have special educational needs and are waiting for an education health and care plan. It is taking up to two years to get some of these plans. Without a plan, they will have to pay VAT, if it is charged. These are children who have suffered trauma and anxiety, who cannot navigate large groups.

“And the Ribble Valley families I know who send their children to private schools are nurses, council workers and taxi drivers. These are normal trying to do the best for their children.

He added: “Going to university is a choice too. It’s not subject to VAT on fees, school books or resources.”

The new government’s intention to remove the VAT exemption from private schools was unveiled this summer although, potentially, there may be changes in the autumn budget. So far, government information says private school and boarding fees for terms starting from January 2025 will be taxable at the standard rate of VAT at 20 per cent.

Education providers that charge school lesson and boarding fees must check if they need to register for VAT because of these changes. For VAT. a private school is defined as any school or institution that provides full time education for a fee to pupils of compulsory school age. Also for 16 to 19 year-old students where that institution is primarily concerned with providing education for that age group. This includes private schools, independent schools and private sixth form colleges.

Private nursery schools for very young children below the legal school starting-age are exempt.

Recently, there have been media reports of divisions between large and small private schools regarding VAT and other tax plans. A recent HM Revenue & Customs tax charges and reclaiming update suggested independent schools will be able to claim-back tax paid on big ‘capital’ projects, such as building or land costs, from the past 10 years. But the autumn budget will confirm the new arrangements.

Wallace & Gromit mania leaves Preston, but the exhibition isn’t gone for good

Wallace & Gromit mania leaves Preston, but the exhibition isn’t gone for good

Preston regeneration projects set for 2026

Preston regeneration projects set for 2026

Traffic cameras set to finally be switched on

Traffic cameras set to finally be switched on

Travel chaos expected in Lancashire as major bridge works get under way

Travel chaos expected in Lancashire as major bridge works get under way

Lancashire-wide campaign launched to help with winter emergencies

Lancashire-wide campaign launched to help with winter emergencies

Lancashire people recognised in King's New Year's Honours List

Lancashire people recognised in King's New Year's Honours List

Hundreds help raise £21K in festive fun run to improve 'Mental Elf'

Hundreds help raise £21K in festive fun run to improve 'Mental Elf'

Lancashire County Council appoints new women and girls' champion

Lancashire County Council appoints new women and girls' champion